2025 has been anything but predictable. There have been short, powerful demand spikes and quieter stretches that defied traditional seasonal trends. Keep reading as we dive into the Q3 2025 market report for Smoky Mountain real estate.

Closed Sales Report

The Q3 2025 market report reflected a steady recalibration as prices continued to normalize and buyer activity held firm across the Smoky Mountains. Smaller homes under $600k saw mild pullbacks, with one- and two-bedroom units down 6-7%, while demand shifted toward larger, higher-end properties. Four-bedroom homes climbed more than 12% to an average of $962k, signaling ongoing strength in the upper market. Sevierville continued to dominate transaction volume, capturing 65% of all closed sales, while Gatlinburg posted the strongest appreciation, up 16% quarter-over-quarter. Price per square foot eased slightly, offering more balanced entry points for investors. Even as pricing adjusted, sale-to-list ratios held above 94% across most segments.

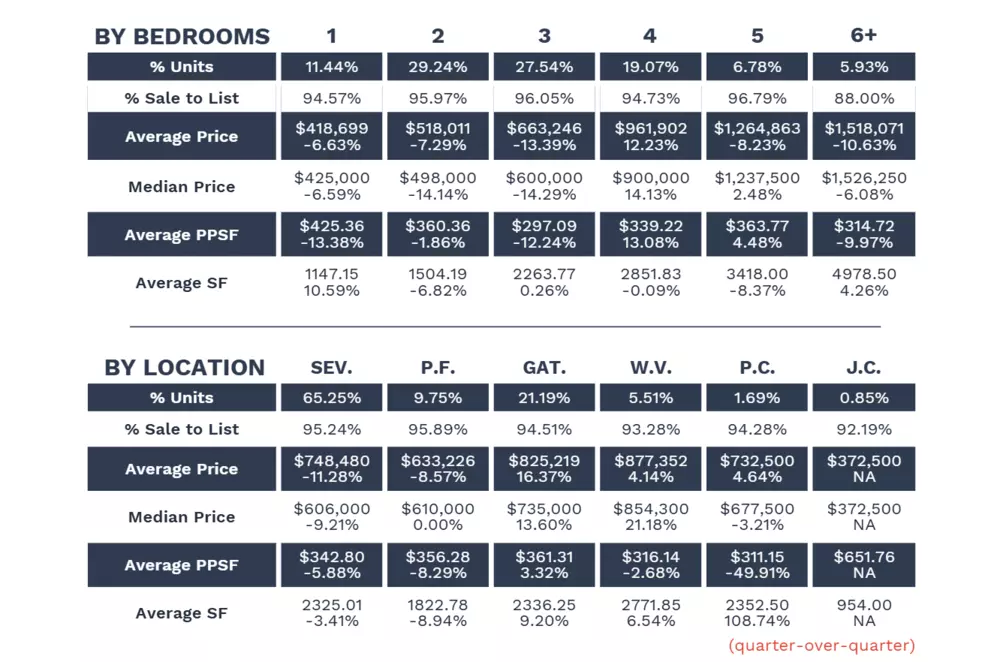

Pending Sales Report

Pending sales in the Q3 2025 market report showed steady market engagement, with total contract activity remaining stable despite pricing adjustments across several categories. One- and two-bedroom homes saw modest gains, while larger properties, particularly those with five or more bedrooms, recorded the steepest quarterly declines, down 7-20%. Sevierville accounted for more than 70% of all pending units and saw a notable 25% rise in median price, signaling continued confidence in core markets. Gatlinburg followed with strong median growth of 12%, even as larger homes stayed on the market longer. Overall, the data reflects a cautious but active buyer pool prioritizing value and manageable scale over luxury expansion.

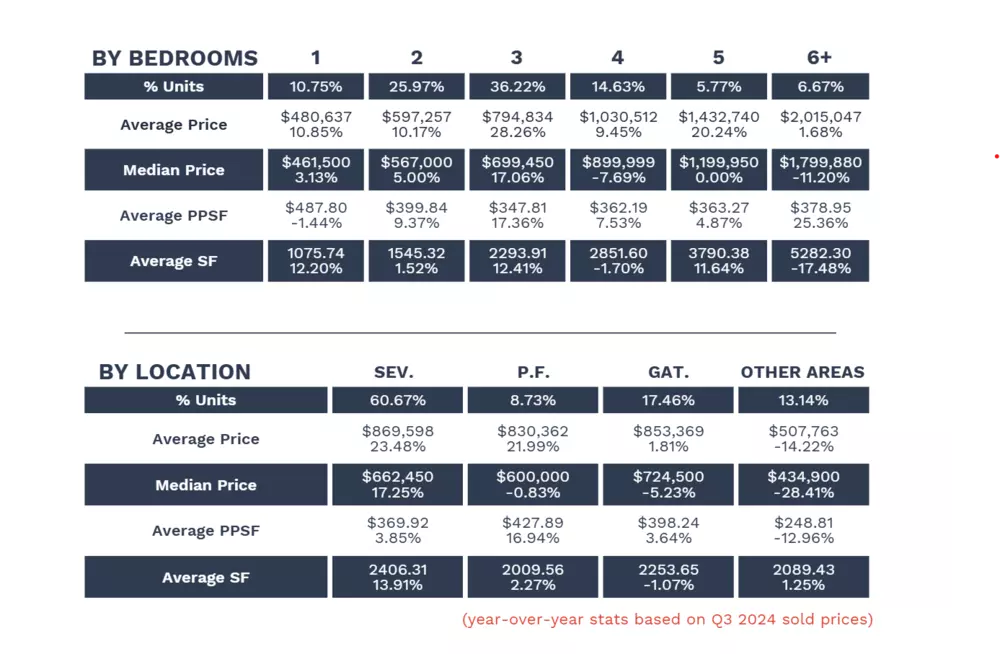

Active Sales Report

Active listings rose in Q3 2025, marking a gradual return to a more balanced market. Average list prices increased across most home sizes, led by three-bedroom properties up 28% year-over-year, while luxury inventory above $1M began to stack up. Sevierville continued to dominate new listings, capturing 60% of all active units and posting strong price gains of more than 20%. Gatlinburg and Pigeon Forge followed with steady growth in mid-range offerings. Months of supply climbed notably in upper brackets, signaling opportunity for investors seeking negotiation flexibility. Overall, Q3 reflected a maturing market, healthy inventory, stable pricing, and a hopeful path toward equilibrium between buyers and sellers.

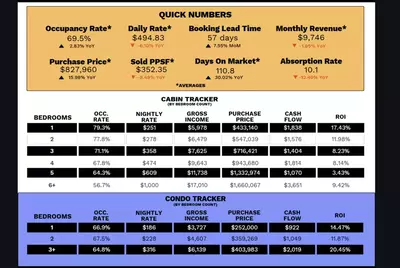

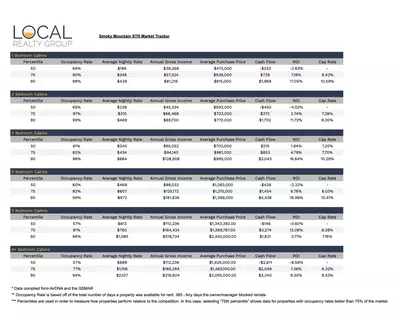

Smoky Mountain STR Report

Seasonal shifts shaped the Q3 2025 short-term rental market, with occupancy easing slightly after the busy summer travel season but profitability improving overall. Nightly rates remained strong, and falling purchase prices gave investors a boost through reduced mortgage costs and higher cash flow potential. One- to four-bedroom cabins continued to outperform, while larger homes sustained impressive gross income even as occupancy softened. Travelers booked an average of 59 days in advance and stayed just over three nights, nearly identical to last quarter’s trends. With lower acquisition prices and resilient rental performance, the Smoky Mountain STR market remains one of the region’s most investor-friendly opportunities heading into Q4.

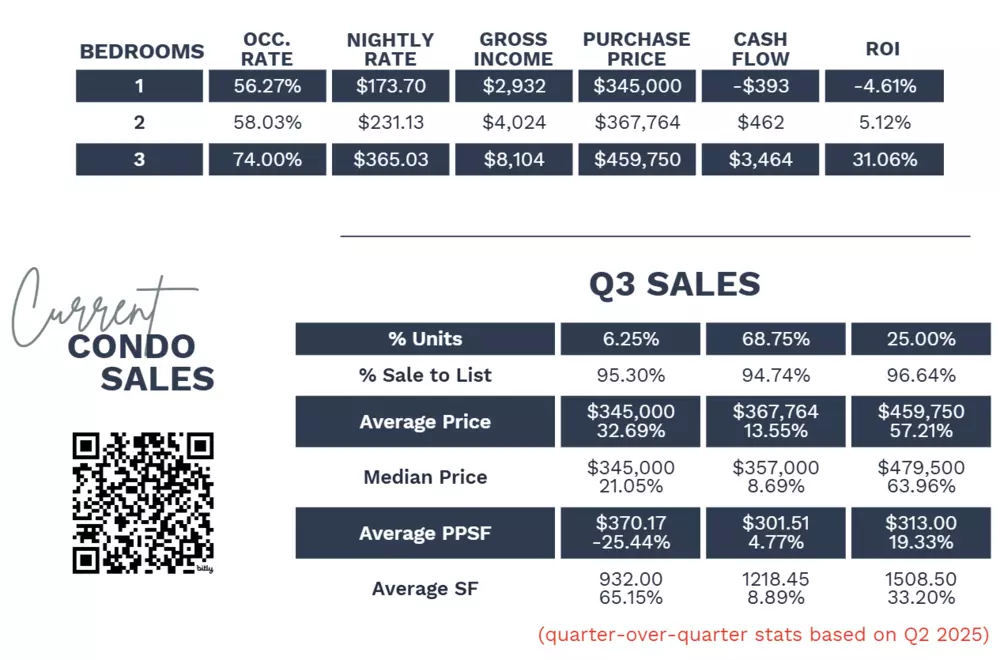

Smoky Mountain Condo Report

The Q3 2025 condo market report showed renewed strength, especially in larger, high-performing units. Three-bedroom condos achieved the highest occupancy and strongest ROI, while smaller units lagged but remained steady in overall absorption. Average sales prices rose more than 30% quarter-over-quarter, supported by growing unit sizes and stable buyer demand. Despite this price growth, the sale-to-list ratio held near 95%, reflecting a confident but balanced market. With rising returns and expanding value options, the Smoky Mountain condo sector is regaining its position as an accessible, income-generating investment class for both new and returning buyers.

Final Thoughts

In 2025, demand surged early, cooled suddenly, and cash flow has been volatile through it all. The “weird” seasonality wasn’t caused by traveler behavior; it was investor timing. As prices normalized, buyers started moving in bursts rather than waves, creating short, powerful demand spikes and quieter stretches that defied traditional seasonal trends.

A widening gap between 3-bedroom and 4-bedroom prices reshaped Q3. As 4-bedroom cabins became more affordable, buyers jumped fast lifting median prices while average prices fell. That shift reignited mid-tier activity and made Q3 2025 the most profitable cash-flow quarter of the year for Smoky Mountain STRs.

What does 2025 have left in store? While we have no true idea, a recent inventory spike is likely a sign of stressful dilemmas for investors. It is likely that the same inventory spike will lead to an increase in demand (pendings) and a decline in average sale prices. So, hold on. Those in strong cash positions will be looking to scoop up properties in good locations with deferred maintenance for rather “sharky” prices.

Invest in the Smoky Mountains

Do you want to learn more about investing in the Smoky Mountains? The experts at Local Realty Group are here to help! Our team has a deep connection to the Smoky Mountain area and wants to help you navigate the local real estate market. We can offer you the information, education, and relationships needed to succeed in real estate. Reach out to us today to get started.