The November 2025 STR Tracker reveals that the Smoky Mountain short-term rental market is shifting but still full of opportunity. By looking closely at occupancy, revenue, pricing, and ROI across both cabins and condos, we can see a clearer picture of where investments are performing best and how the market is evolving. Keep reading to join us as we dive into the November 2025 STR tracker.

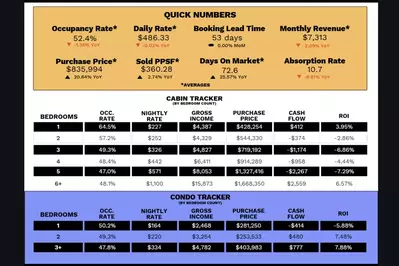

Market-Wide Averages Signal Adjustment, Not Decline

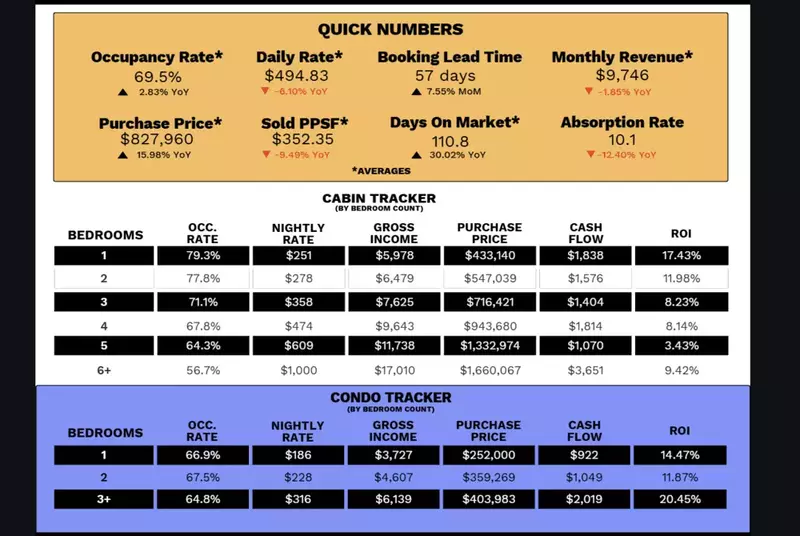

Several metrics in the November 2025 STR tracker point to a market recalibrating after an unusually strong period.

- Average Occupancy Rate was 69.5%, up 2.83% YoY, signaling more consistent guest demand even as travel patterns shift.

- Average Daily Rate dipped 6.10% YoY to $494.83, contributing to a slight 1.85% decline in average Monthly Revenue.

- Average Sold Price Per Square Foot dropped 9.49% YoY to $352.35, yet average Purchase Price rose nearly 16% to $827,960, suggesting buyers are still paying premiums for larger or higher-end properties.

- Average Days On Market increased significantly to 110.8 days, a 30% jump YoY, meaning buyers have more negotiating leverage than they did last year.

- The Absorption Rate fell to 10.1, down 12.40%, reinforcing a slower, more balanced market.

Overall, the Smoky Mountain STR market is cooling from the frenzy of prior years, but demand remains strong enough to support solid, stable performance for well-positioned properties.

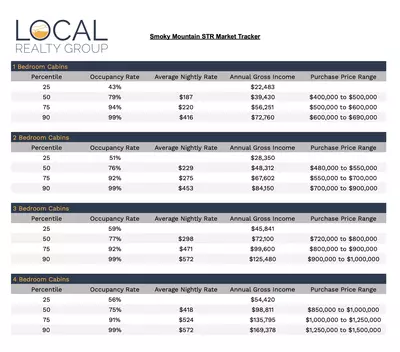

Smoky Mountain Cabins

One of the clearest trends in the November 2025 STR tracker is the sharp contrast in cabin performance by bedroom count. 1-bedroom cabins continue to offer the strongest returns thanks to lower purchase prices and consistent demand. 2- and 3-bedroom cabins show moderate performance. These mid-sized cabins balance affordability and stable rental income, though return percentage declines as prices rise. Large cabins continue to struggle with ROI. 5-bedroom and 6+ bedroom properties attract group travel but face rising operating costs and an increasingly competitive luxury segment. They can still perform extremely well but require strategic pricing and strong management.

Smoky Mountain Condos

The November 2025 STR tracker shows condos delivering outstanding returns, rivaling and even surpassing many cabin categories. These properties have lower purchase prices, strong occupancy, and steady nightly rates that align with guest expectations. 3+ bedroom condos are the top performers, with 20.45% ROI. This is the highest ROI of any property type this month, highlighting the growing demand for affordable, multi-bedroom stays. Even 1- and 2-bedroom condos show impressive returns at 14.47% and 11.87%, comparable to similarly sized cabins. For investors priced out of the cabin market or seeking lower-maintenance properties, condos are a standout option.

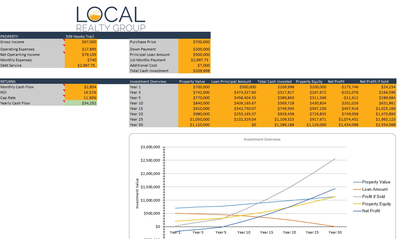

What This Means for Smoky Mountain Investors

Here are some key takeaways for investors from the November 2025 STR tracker:

- Demand is stable, even as rates soften.

- Cabins under 3 bedrooms perform best, while large luxury cabins require careful strategies.

- Condos are delivering exceptional ROI, especially 3+ bedroom units.

- With longer days on market and lower PPSF, buyers today have more negotiating power than at any point in the last few years.

Invest in the Smoky Mountains

Local expertise makes the biggest difference. Whether you’re searching for high-performing properties or affordable entry points, Local Realty Group is here to help you make confident decisions in the Smoky Mountain STR market. Reach out to us today to learn more about investing in the Smoky Mountains.