We’re already over halfway through 2025, so it’s time to look at how the Smoky Mountain real estate market is performing so far. Market saturation is catching up, causing a drop in prices that’s driving activity. Keep reading as we dive into the 2025 mid-year Smoky Mountain real estate market report.

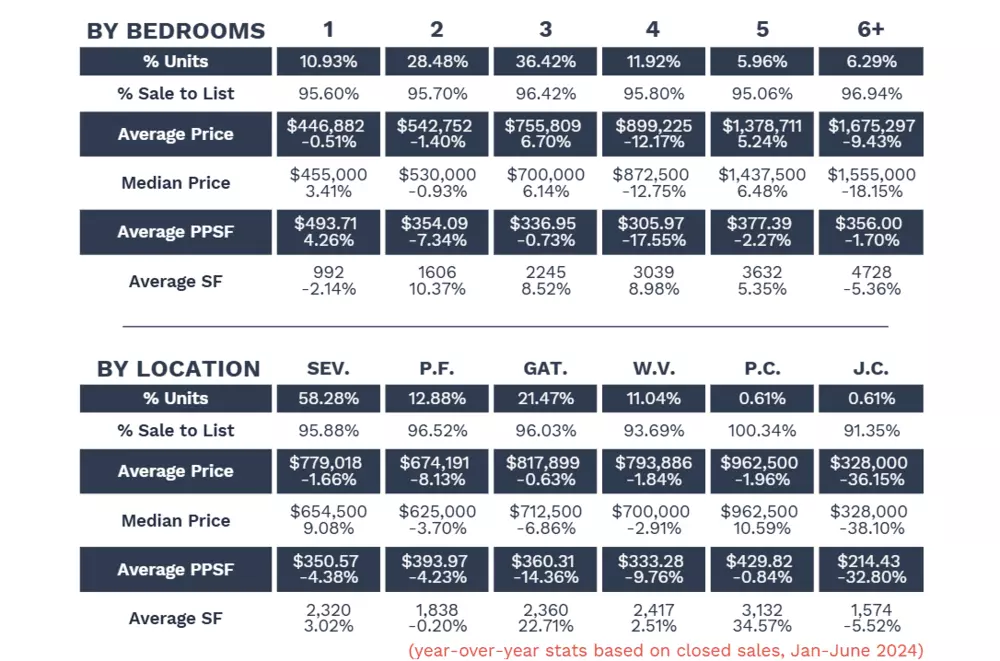

Closed Sales Report

The 2025 mid-year Smoky Mountain real estate market report reveals notable insights across various property segments. Three-bedroom properties lead the market, representing 36.42% of total closed sales, with a strong average sale-to-list ratio of 96.42%. However, the luxury market (6+ bedrooms) has seen a slight decline in both average price and price per square foot, marking a meaningful shift. Just 12 months ago, three-bedroom cabins were selling for $850,000 and four-bedrooms for $1,000,000. These improving purchase prices should improve inventory levels in those segments and provide investors with more consistent returns.

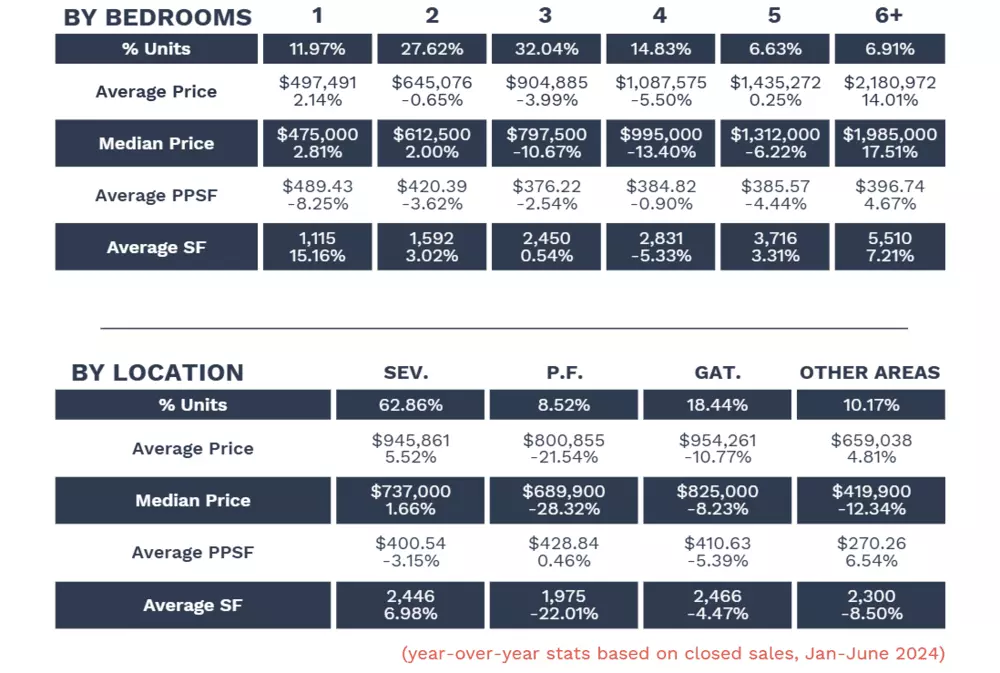

Pending Sales Report

The mid-year real estate market report shows significant growth in key market segments for pending sales. Two-bedroom homes lead in market share at 34.76%, while three-bedroom properties show the strongest price growth with average prices rising by 23.21%. The luxury sector continues to perform well, maintaining substantial median prices despite slight declines in price per square foot. This data tells an interesting story. If the sale-to-list ratio from the closed sales report holds, both four-bedroom and 6+ bedroom properties are likely to see average price increases next quarter. This reflects the volatility of the market, and it’s likely this trend will continue across all segments, driven by the supply and demand dynamics unique to each property type.

Active Sales Report

According to the 2025 mid-year Smoky Mountain real estate market report, three-bedroom homes hold the largest market share at 32.04%, though median prices in this category have declined by 10.67%. Meanwhile, luxury properties continue to show strength, with both average and median prices posting significant year-over-year gains. Sevierville remains the dominant submarket, representing 62.86% of active listings and showing a 5.52% increase in average prices. The recent performance of three-bedroom properties appears strong at first glance, but active inventory in this segment has been declining for several quarters. While pending and sold comps look favorable, the broader trend suggests that recent sales are being driven more by over supply and market saturation than by growing demand.

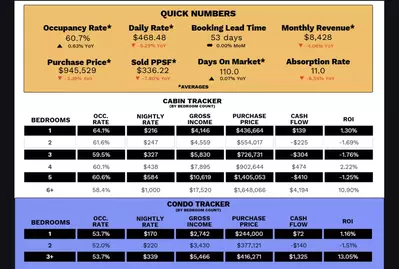

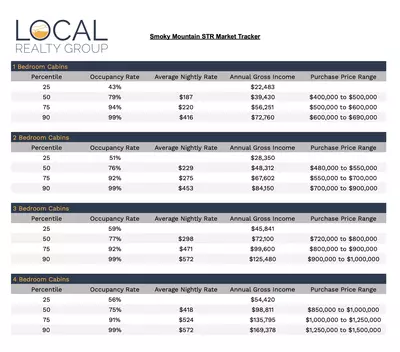

Smoky Mountain STR Report

Smoky Mountain short-term rentals (STRs) with one bedroom demonstrate the highest occupancy rates at 59.25%, but profitability emerges prominently with larger units (6+ bedrooms), showing positive cash flow and robust gross rental multipliers (GRM). Year-over-year data highlights notable declines in occupancy, nightly rates, and gross income for smaller properties (1-2 bedrooms), suggesting market saturation in this segment. Booking patterns reveal most guests book around two months in advance, with a typical stay length of 3.4 days. Total market revenue in 2025 significantly surpasses 2024, underscoring a resilient market and sustained demand in the Smoky Mountains.

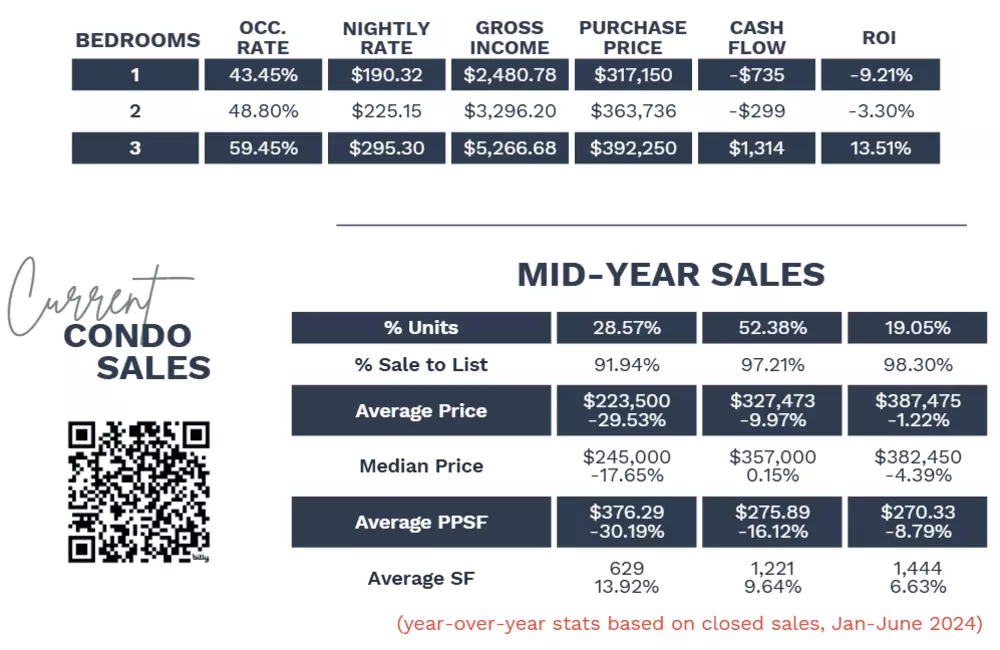

Smoky Mountain Condo Report

The 2025 mid-year real estate market report for Smoky Mountain condos highlights significant performance variations among property sizes. Three-bedroom condos demonstrate superior returns with occupancy rates of 59.45%, positive cash flow, and an impressive ROI of 13.51%. Smaller units (1-2 bedrooms) experience negative cash flows, indicating possible market oversupply or pricing issues. Mid-year sales reveal two-bedroom condos constitute the majority of transactions at 52.38%, though average prices declined slightly year-over-year. Active condo rental listings remain stable, with a minor growth in three-bedroom availability. Overall, this suggests three-bedroom condos offer the strongest investment opportunity in the Smoky Mountain area.

Final Thoughts on the 2025 Mid-Year Smoky Mountain Real Estate Market Report

Three-bedroom cabins look strong on the surface with solid pending activity and sold comps, but smart investors know better than to get distracted by short-term data. Over the past three quarters, this segment has led the market in both inventory and price declines, with median prices falling 10.67% year-over-year. That drop is driving activity, not demand. What we’re seeing isn’t strength; it’s market saturation catching up. Saturation is quietly reshaping this segment. Despite appearances, three-bedroom properties have delivered the weakest returns of any category, quarter after quarter. This is exactly why tracking multiple quarters of performance matters. Without that context, it’s easy to mistake pricing corrections for momentum.

That said, the broader STR market remains resilient and investable. Volatility hasn’t erased opportunity, especially with the return of 100% bonus depreciation, which puts powerful tax incentives back on the table for buyers who know where to look.

Are you interested in investing in Smoky Mountain real estate? Browse our featured properties for sale in Sevier County to get started!