The Smoky Mountain real estate market shows clear signs of correction in the second quarter of 2025. Prices have finally given way to market pressure, especially in mid-tier properties. Join us as we dive into the Q2 2025 Market Report and what it means for real estate investors.

Closed Sales Report

The Q2 2025 Closed Sales Report provides a detailed breakdown of residential property sales by bedroom count, location, and price segment. In the Smoky Mountain real estate market, 3-bedroom homes represented the largest share of closed sales at 38%, while the highest average price was for 6+ bedroom homes at $1.7M. Properties in Sevierville made up nearly 59% of all sales, with an average price of $843K and a strong average price per square foot (PPSF) of $364.23. The highest PPSF was seen in 1-bedroom homes at $491.06. Most homes sold for under $500,000 (28% of total sales), and sale-to-list ratios remained strong across all price points, with an average of 96% or higher.

Pending Sales Report

The Q2 2025 Pending Sales Report highlights a notable shift in market activity, with the majority of pending transactions concentrated in 2-bedroom homes (35%) and properties priced under $500K (20.4%). Average pending sale prices increased in key segments–particularly 3-bedroom homes (up to 10.91%) and the Gatlinburg area (up to 20.42%). Despite this, overall PPSF declined across most categories, indicating value-conscious buyer behavior. The largest volume of pending sales remains in Sevierville (57%), though the average price there fell nearly 20% quarter-over-quarter. Days on market varied significantly by price, peaking in the $800-$900K range, signaling slowing activity in higher-end inventory.

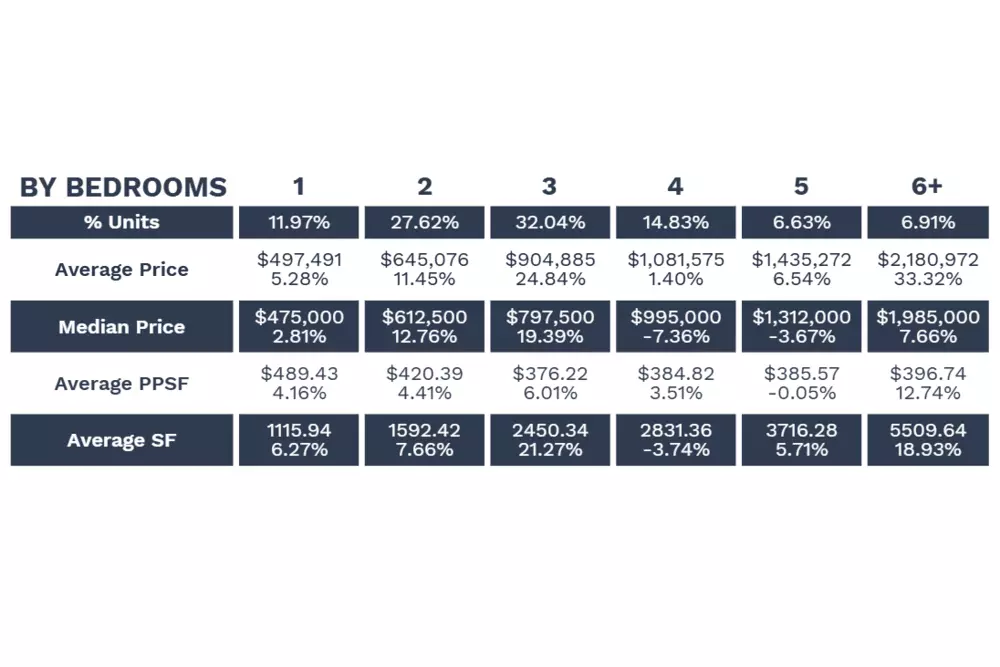

Active Sales Report

The Q2 Active Sales Report for the Smoky Mountain real estate market reveals a growing inventory of higher-priced listings, with 3- and 2-bedroom homes comprising the largest share of active units (32% and 28%, respectively). Notably, average list prices rose sharply in the 3-bedroom (+24.84%) and 6+ bedroom (+33.32%) segments. Sevierville holds the majority of active listings (63%) with an average price of $946K and a median price up 25.45% year-over-year. Despite rising prices, the highest supply is concentrated in luxury tiers–especially the $2M+ category, which shows over 27 months of inventory. This signals a potential oversupply at the top of the market and slower absorption for high-end properties.

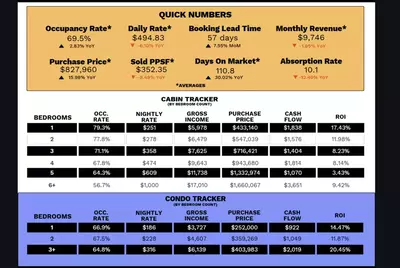

Smoky Mountain STR Report

The Q2 Smoky Mountain STR Report shows strong short-term rental performance, particularly among larger homes. 6+ bedroom properties led with the highest nightly rate ($1,054.80), gross income ($18,438), and positive cash flow ($4,150). Additionally, 6+ bedroom properties yield the best GRM at 7.68. Q2 2025 saw notable gains in gross income across all bedroom counts, with 4-bedrooms up 46.67% from Q1 2025. Booking lead time averaged 59.3 days, with most stays lasting 2-3 nights. Total market revenue trends indicate a rebound from early-year dips, supporting continued STR investor interest.

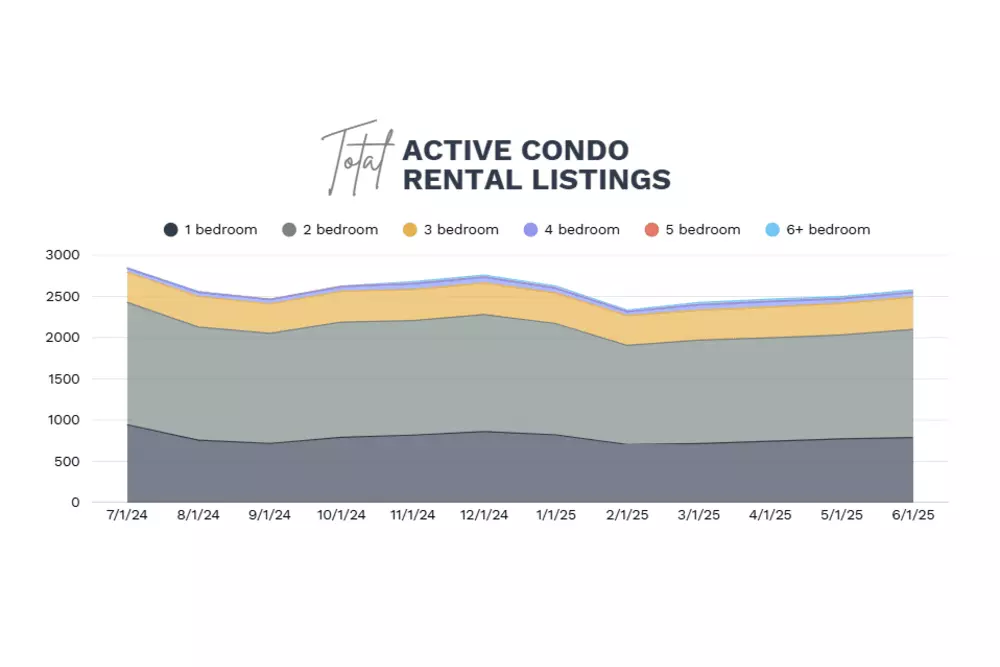

Smoky Mountain Condo Report

The Q2 2025 Smoky Mountain Condo Report highlights ongoing challenges in condo investment performance. All bedroom types posted negative cash flow and ROI in Q2, with 2-bedroom units showing the steepest ROI decline at -10.37%. 3-bedroom condos generated the highest gross income ($6,779) but still failed to break even. Despite weaker returns, condo sales activity increased for 1-bedroom units, with average prices up 39.04% and median prices rising nearly 89% quarter-over-quarter. However, shrinking average square footage suggests demand is shifting toward smaller, more affordable units. Active condo rental listings remained relatively stable, though inventory for 2- and 3-bedroom units continues to dominate the market.

Final Thoughts

In Q2 2025, prices have finally responded to mounting inventory and affordability pressure, especially in mid-tier properties. The above trends highlight the growing risk of investing in the middle of the market, while small homes remain resilient with strong demand and price efficiency and large homes continue to deliver strong returns and positive cash flow. A barbell strategy is the clearest path forward: concentrate investments on the low and high ends of the market and avoid the bloated, underperforming middle.

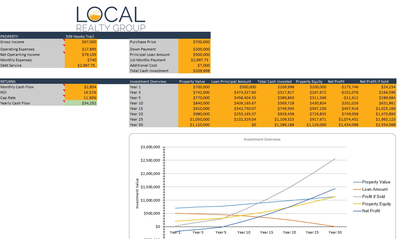

Do you want to learn more about investing in the Smoky Mountains? The experts at Local Realty Group are here to help! Our team of real estate professionals has a deep connection to the area and wants to help you navigate the Smoky Mountain real estate market. We can offer you the information, education, and relationships needed to succeed in real estate. Reach out to us today to get started!