With year-round tourism and strong rental demand, the Smoky Mountains offer excellent opportunities for investors. Investing in short-term rentals (STRs) in this market can be highly lucrative, but you need to make strategic decisions. Before you buy, it’s important to understand how to properly evaluate potential rental property profitability. In this guide, we’ll break down the key factors you should analyze to determine whether a Smoky Mountain rental property is a smart and profitable investment.

1. Understand Local Market Demand

The first step in analyzing potential rental property profitability is understanding rental demand in the local Smoky Mountain market. Unlike many other destinations, the Smokies benefit from consistent tourism throughout the year. Summer vacations, spring break getaways, holiday travel, and fall leaf peeping trips all drive strong occupancy for short-term rentals. If you’re looking to invest, research average occupancy rates for similar properties in the area you’re considering. Additionally, rentals with mountain views, proximity to attractions, or luxury amenities tend to perform the best in the Smoky Mountain STR market.

2. Estimate Gross Rental Income

Once you understand demand, you need to estimate your potential rental income. Look at comparable rental properties to determine realistic nightly rates during peak and off-peak seasons. Smoky Mountain STR income is highly seasonal, so your projections should account for pricing fluctuations throughout the year. Avoid relying on best-case scenarios; conservative estimates lead to better long-term profitability and fewer surprises. Your rental income projection should include:

- Average nightly rate

- Expected occupancy percentage

- Seasonal pricing variations

These estimates will give you a clearer picture of annual gross revenue.

3. Calculate Operating Expenses

Rental property profitability isn’t just about revenue. It’s about what’s left after expenses. Smoky Mountain STRs typically come with higher operating costs than long-term rentals due to frequent guest turnover and property wear. Properties in the mountains may also require additional maintenance due to weather, terrain, and wildlife. Calculate common expenses such as:

- Utilities

- Insurance and property taxes

- Cleaning and maintenance

- Property management fees

- Repairs and replacements

- HOA fees

Accurately accounting for these costs is critical to understanding your true potential profit margin.

4. Analyze Cash Flow and ROI

After estimating income and expenses, you need to estimate your potential cash flow. Positive cash flow means your property earns more than it costs to operate. From there, you can evaluate your return on investment (ROI) by comparing annual profits to your initial investment, including down payment and closing costs. Many STR investors also consider cash-on-cash return, which focuses on the actual cash invested rather than the property’s total value. This metric is especially useful for comparing multiple Smoky Mountain STR opportunities.

5. Evaluate Financing and Tax Considerations

Your financing strategy has a major effect on potential rental property profitability. Interest rates, loan terms, and down payments all affect monthly expenses. There are many financing options available to Smoky Mountain STR investors, such as conventional mortgages and DSCR loans. Additionally, tax conditions in Tennessee are favorable for STR owners, and you could benefit from tax deductions related to depreciation, operating expenses, interest, etc. Consulting with a tax professional can help you maximize returns.

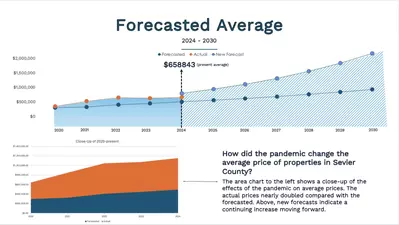

6. Consider Appreciation and Long-Term Value

While cash flow is crucial, long-term appreciation also plays a role in rental property profitability. The Smoky Mountains continue to be a very popular vacation destination, supporting steady property value growth over time. A profitable STR investment balances immediate income with long-term equity gains. Properties with good locations and strong rental histories tend to perform best in both short-term profitability and long-term value.

7. Work with Local Experts

Analyzing potential rental property profitability is much easier and more accurate when you work with professionals who understand the Smoky Mountain short-term rental market. From providing insights into neighborhood performance to realistically estimating income and expenses, local expertise can make the difference between an average investment and a highly profitable one.

If you’re considering investing in Smoky Mountain STRs, Local Realty Group is here to help. Our team specializes in short-term rental properties throughout the Smokies, and we can provide you with data-driven insights and personalized guidance every step of the way. Reach out to us today to get expert help in finding the right investment to meet your financial goals.