One of the oldest questions in real estate is whether it is better to try to predict the market’s ups and downs or to stay invested for the long haul. Many short-term rental (STR) investors have wondered whether it’s smarter to wait for a real estate market crash or to just buy now and hold. However, time in the STR market almost always beats timing the market. Keep reading to find out why.

Why Timing the STR Market is Hard

Timing the STR market may sound like a great idea. The theory is to buy when prices are low, sell when prices peak, and make a large profit in between. However, even the most experienced STR investors struggle to do this consistently. Real estate markets are influenced by complex factors, such as economic cycles, interest rates, supply and demand, consumer confidence, etc., and these shifts can be very difficult to accurately predict. Economic downturns, government policies, and sudden spikes in demand can all influence the STR market. Additionally, many investors who wait for a dip in the market end up waiting too long and miss the opportunity to buy when prices are low. Fear and greed often drive market timing, leading to panic, hesitation, and, ultimately, poor financial decision making.

The Power of Time In the STR Market

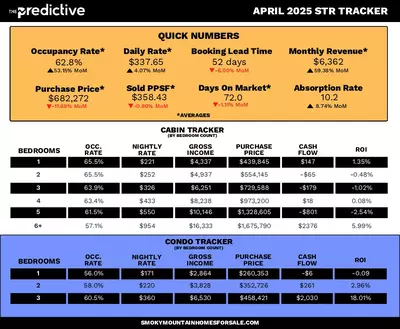

Long-term STR investing relies on the simple principle that real estate tends to go up in value over time. If you own a property in a strong STR market like the Smoky Mountains, history suggests that your investment will appreciate significantly if you hold onto it. In this market, home values have steadily risen over decades. Even with market fluctuations, the overall trend remains upward. Additionally, owning an STR property long-term means you can generate passive income through rent. Even if the property’s value dips temporarily, rental demand remains strong and rates continue to increase over time. There are also tax advantages that long-term STR investors can benefit from, and rental income covers your mortgage for you, allowing you to build equity over time.

How to Approach Long-Term STR Investing

There are a few ways to maximize your chances of successful long-term STR investments. Some key strategies to follow include:

- Buy in growth markets – Focus on areas with strong growth, such as tourism appeal, increasing population, and solid infrastructure. The Smoky Mountains STR market tends to present lucrative investment opportunities.

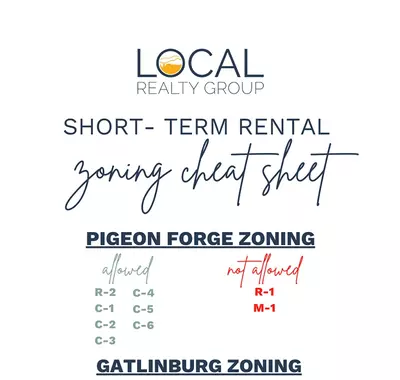

- Choose properties with strong rental potential – Even if the market slows, an STR property that cash flows will continue to generate income. Look for properties with desirable locations, attractive amenities, and favorable local regulations.

- Utilize smart financing – If you are concerned about high mortgage rates, explore creative financing options. These might include adjustable-rate mortgages (ARMs), seller financing, etc.

- Stop looking for the “perfect” moment – Instead of obsessing over market timing, look at whether a property makes financial sense right now.

The Verdict: Time In the Market Prevails

Investing in the STR market isn’t about perfect timing; it’s about how long you stay in the game. The longer you hold on to your investment property, the greater your chances of building wealth through real estate appreciation and rental revenue.

Investing in the Smoky Mountains market is a compelling choice for long-term real estate investment in short-term rentals. To ensure a successful investment, focus on buying well and holding on to your STR for the long haul. Are you ready to get started? Find out more about buying Smoky Mountain real estate and let Local Realty Group guide you every step of the way!