Interest rates are a critical factor for all types of real estate investors, but they are particularly impactful for short-term rental investors. When the Federal Reserve cuts interest rates, it influences not only the cost of borrowing but also the broader economic environment. Understanding how these changes can affect your investments is essential for making informed decisions. In this blog, we’ll explore what short-term rental investors should expect if interest rates go down, and how to position your portfolio to maximize opportunities.

Lower Mortgage Rates: An Opportunity For Acquisition Or Refinancing

One of the most immediate and noticeable effects of a Federal Reserve rate cut is the reduction in mortgage interest rates. Based on our data, a reduction in the Fed rate from 5.50% to 4.50% can decrease mortgage interest rates from around 7.00% to 5.90%.

For short-term rental investors, this change means cheaper access to capital. Lower mortgage rates make it more affordable to purchase new properties or refinance existing loans. Let’s break down the impact using a scenario:

Scenario A: No Rate Cut

- At a 7.00% mortgage interest rate, a typical monthly payment on a $1 million property is around $5,625.90. This translates to an annual cost of $67,510.80.

Scenario B: Moderate Rate Cut

- With a moderate cut, bringing the rate down to 6.20%, the monthly payment drops to $5,179.13, and the annual cost to $62,149.56.

Scenario C: Large Rate Cut

- A more substantial cut to 5.90% further reduces the monthly payment to $5,015.65 and the annual cost to $60,187.80.

These reductions can significantly lower the cost of owning a short-term rental property, freeing up capital for other investments or operational costs. Moreover, refinancing at a lower rate could reduce your monthly outgoings, improving your cash flow.

Increased Cash Flow And Profit Margins

With lower interest rates, short-term rental investors can expect improved cash flow and profit margins. The data illustrates a direct correlation between reduced mortgage payments and increased net income. Here’s how:

At a 7.00%mortgage interest rate, the net annual income is around $39,168.

After a moderate rate cut, this income jumps to $44,532.

With a more significant cut, net annual income rises further to $46,500.

For short-term rental investors, this means more money in your pocket each year. With a healthier cash flow, you have the flexibility to reinvest in property improvements, expand your portfolio, or cushion against market fluctuations.

Increased Cash Flow And Profit Margins

With lower interest rates, short-term rental investors can expect improved cash flow and profit margins. The data illustrates a direct correlation between reduced mortgage payments and increased net income. Here’s how:

At a 7.00%mortgage interest rate, the net annual income is around $39,168.

After a moderate rate cut, this income jumps to $44,532.

With a more significant cut, net annual income rises further to $46,500.

For short-term rental investors, this means more money in your pocket each year. With a healthier cash flow, you have the flexibility to reinvest in property improvements, expand your portfolio, or cushion against market fluctuations.

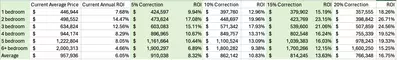

Higher ROI Potential

The return on investment (ROI) is a critical metric for any real estate investor. Lower interest rates can positively affect ROI by reducing the cost of borrowing and increasing the net rental income. According to the data:

At a 7.00% rate, the ROI in the first year is approximately 16.08%.

After a moderate rate cut, the ROI increases to 18.69%.

With a large cut, it can reach up to 19.68%.

This higher ROI is primarily due to reduced borrowing costs and improved cash flow. For short-term rental investors, a higher ROI could mean quicker recovery of the initial investment and increased profitability over time.

Increased Demand in the Real Estate Market

Lower interest rates generally stimulate demand in the real estate market. As mortgage rates decline, more potential buyers can afford to enter the market, driving up property values. For short-term rental investors, this can lead to several benefits:

Increased Property Value: As demand rises, so do property values. If you already own properties, you could see an appreciation in your assets’ value, enhancing your net worth and equity.

Improved Exit Opportunities: With higher property values, you have more favorable conditions if you decide to sell one or more properties. Selling in a high-demand, low-interest-rate environment could result in a quicker sale at a better price.

Opportunity for Expansion: Lower rates make it more affordable to acquire additional properties, allowing you to expand your portfolio while market conditions are favorable.=

More Attractive to Travelers: Boosting Occupancy Rates

For short-term rental investors, it’s not just about the cost of borrowing; it’s also about occupancy rates and rental income. Lower interest rates can stimulate consumer spending, including travel and tourism. Here’s how it works:

Higher Disposable Income:

As consumers benefit from lower borrowing costs, they may have more disposable income, which can translate to increased spending on travel and accommodation.

Lower Cost of Financing for Travel:

Reduced interest rates also mean that the cost of financing travel, such as using credit cards or taking personal loans, becomes cheaper. This factor can encourage more people to travel, boosting demand for short-term rentals.

For short-term rental investors, this uptick in travel demand could mean higher occupancy rates and potentially higher nightly rates, leading to increased revenue.

Risks to Consider: Overheating of the Market

While there are several advantages to lower interest rates, short-term rental investors should also be mindful of potential risks:

Market Overheating: Lower interest rates can sometimes lead to an overheated real estate market, where property prices become inflated. Investors should be cautious not to overpay for properties in a low-rate environment.

Increased Competition: As rates drop, more investors may enter the short-term rental market, increasing competition. This surge could lead to a saturation of rental properties in certain areas, potentially driving down occupancy rates and nightly rates.

Economic Volatility: Although lower rates generally stimulate growth, they can also signal underlying economic concerns. It’s essential to monitor broader economic indicators to ensure you’re making investment decisions that are sustainable in the long term.

Strategic Moves for Short-Term Rental Investors in a Low-Rate Environment

To maximize the benefits of lower interest rates, consider the following strategies:

Refinance Existing Properties: If you have properties with higher interest rates, consider refinancing to lock in lower rates. This move can significantly reduce your monthly expenses and increase cash flow.

Expand Your Portfolio: Take advantage of lower borrowing costs to acquire additional properties. Focus on locations with strong demand and limited supply to mitigate the risk of market saturation.

Enhance Property Appeal: Use the improved cash flow to invest in property upgrades or unique amenities that can differentiate your listings and attract more guests.

Monitor Market Conditions: Stay informed about broader economic trends. While lower interest rates offer opportunities, they may also signal potential challenges ahead. Be prepared to adjust your strategy as needed.

Conclusion

Lower interest rates create a favorable environment for short-term rental investors by reducing borrowing costs, increasing cash flow, and boosting ROI. However, it’s essential to remain vigilant about market conditions and potential risks. By strategically positioning your portfolio and taking advantage of the opportunities that lower rates provide, you can enhance your investment returns and ensure long-term success.

Connect with an Agent

Interested in learning more? Look no further! Click the button below to connect with an agent that can get you more information.