Profit Potential exist through Price Corrections for Smoky Mountain Short-Term Rentals

Thinking about investing in the Smoky Mountains? The current real estate trends suggest that now might be the perfect time, especially if you’re considering short-term rentals. Let’s delve into how adjusting property prices can significantly boost your return on investment and make your venture into the Smoky Mountains a profitable one.

The Power of Price Corrections

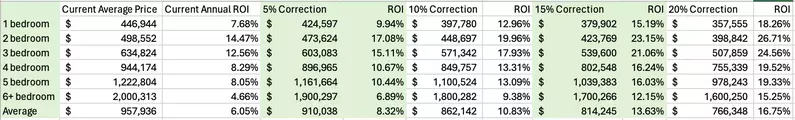

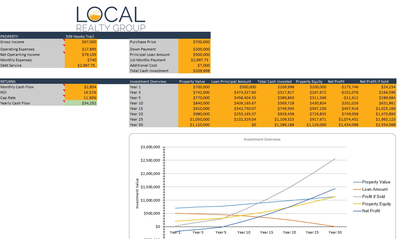

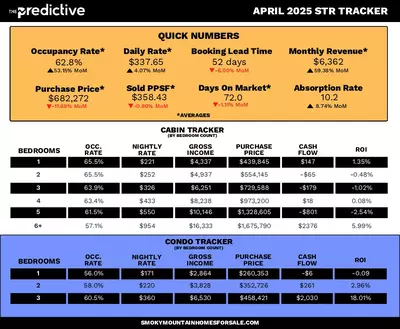

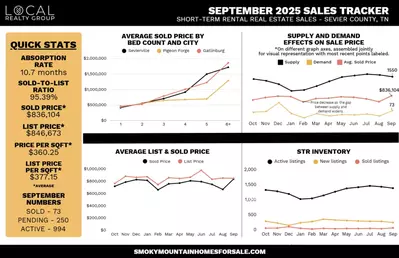

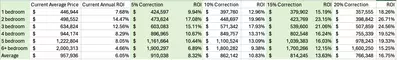

In the Smoky Mountains, tourist demand remains consistently high throughout the year, the short-term rental market is particularly ripe for investors. Despite the consistent returns over the years new investors are experiencing their first “off season” as occupancy rates are down. That coupled with the high cost to enter the Smoky Mountain Market has left many investors with less than desirable returns. However, what should investors expect if the current market remains steady? Given the mild corrections over the past 6 months what should investors making purchases this year expect as a return? Even with the high interest rates data suggests that a price correction of a additional 7-10% will dramatically enhance your ROI, making these properties even more attractive investments and generating cash flow numbers that have traditionally been desired by investors.

Market Dynamics and Profitability

The Smoky Mountains are not just a beacon for nature lovers but also a hotspot for savvy investors. Despite the area’s natural appeal, recent insights indicate that the market could benefit from price corrections. Such price corrections are needed not just to decrease the barrier of entry into this market but also to optimize investments to better meet market demand and enhance profitability.

Strategic Investment Tips

To maximize your earnings from a short-term rental in the Smoky Mountains, consider the following:

- Location and Amenities: Properties near popular attractions or those that offer unique amenities such as outdoor spaces, indoor pools, panoramic views, and theater rooms perform better. Such features significantly enhance guest satisfaction and can justify premium rental rates (LOCAL Realty Group).

- Flexible Management: Utilizing flexible and dynamic pricing strategies to adjust for seasonal peaks and troughs can also maximize profitability. Investors need to think strategically about how/who will manage their properties and what the best ways are to streamline their process, ensuring that your property remains competitive and profitable throughout the year. Check out our previous blog on 5 questions every STR should ask when evaluating their Short Term Rental.

Ready to Dive In?

Adjusting property prices in the Smoky Mountains could be your key to unlocking significant profits in the short-term rental market. With the region’s enduring popularity and the strategic advantage of market timing, investors have a unique opportunity to capitalize on a thriving market. Lower initial costs, combined with high demand, pave the way for robust returns, making this a prime time to invest.

Embrace the potential, invest wisely, and watch as your Smoky Mountain property becomes not just your prefered retreat, but a profitable asset in your real estate portfolio.