The latest short-term rental (STR) tracker for August 2025 reveals significant shifts within the Smoky Mountain market. We’ve identified three key takeaways that property owners and new investors should know. Keep reading to join us as we dive into the August 2025 STR tracker:

1. Purchase Price

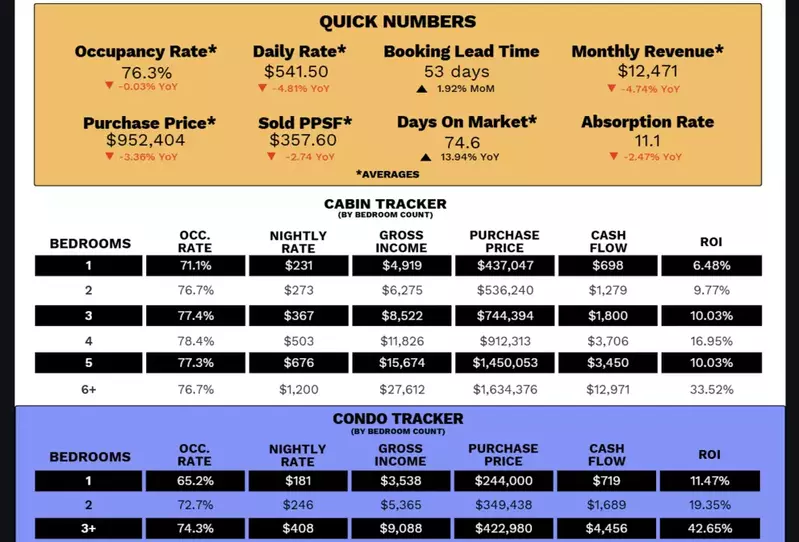

One of the notable developments in the August 2025 STR tracker is an observed decline in the average purchase price for short-term rental properties in the Smoky Mountain market. The average purchase price was $952,404, which is down 3.36 percent compared to last year and down approximately $1,200 compared to June 2025. This trend suggests a potential cooling in the market, most likely due to inventory saturation. For new investors, this could present a great opportunity to enter the Smoky Mountain STR market or expand your existing portfolio at a more favorable price point. Conversely, current owners who are considering selling may need to adjust their expectations regarding listing prices.

2. Average Daily Rate

The August 2025 STR tracker shows a dip in the average daily rate (ADR) compared to this time last year. At $541.50, ADR is down 4.81 percent year-over-year. This reduction could be attributed to increased competition among rental properties or a general adjustment in consumer spending habits. However, ADR and occupancy rate are both up compared to June 2025, which could indicate a shift in peak summer travel times. Short-term rental owners may want to utilize dynamic pricing models and special promotions to maximize ADR and occupancy rates as well as attract guests as we move into what is typically a slower month in the STR market.

3. Monthly Revenue

As shown in the August 2025 STR tracker, average monthly revenue was $12,471. This is down 4.74% year-over-year, but it is up over $5,000 compared to June 2025. This reveals a positive trend this year. The continued growth in monthly revenue highlights the enduring appeal of the Smoky Mountains as a premier short-term rental destination. Property owners who strategically adapt to market shifts, embrace dynamic pricing, and focus on enhancing guest experiences are well-positioned to maintain and improve their financial performance. For new investors, this upward trend in monthly revenue, coupled with favorable purchase prices, presents a compelling opportunity for entering or expanding within the Smoky Mountain STR market.

August 2025 STR Tracker Quick Numbers

In addition to the above trends, you may also want to know the following STR data averages in the Smoky Mountain market for August 2025:

- Occupancy Rate: 76.3% (down 0.03% YoY)

- Booking Lead Time: 53 days (up 1.92% MoM)

- Absorption Rate: 11.1 (down 2.47% YoY)

- Days on Market: 74.6 (up 13.94% YoY)

- Sold PPSF: $357.60 (down 2.74% YoY)

Investing in the Smoky Mountain STR Market

Short-term rentals can be a lucrative investment in the Smoky Mountain real estate market. At Local Realty Group, we offer a unique understanding of the local STR market to help you make informed decisions and optimize your investment strategy. Reach out to us today to find out how we can help you invest in the Smokies and build wealth with short-term rentals!